摘要: When Decoupling? Maybe soon (but probably not).

▲圖片標題(來源:coindesk)

The Decoupling. The latest iteration of “hopium” for bitcoiners and crypto natives. When it finally inevitably happens, it’ll be up only for Big Crypto and down only for Big Fiat.

But what it actually means is a bit funny. The Decoupling is the moment when bitcoin’s price diverges from equities and starts going up when equities go down (and vice versa). The Decoupling is the moment when bitcoin (BTC) and equities become negatively correlated to each other. Bitcoin will go to $1 million a coin and equities will spiral to zero.

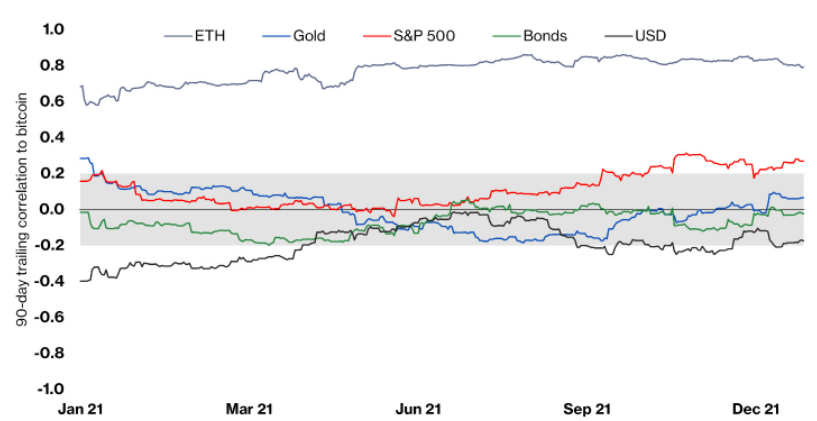

It’s a bit funny because bitcoin was uncorrelated to almost all macro assets (gold, S&P 500, bonds, U.S. dollar) not too long ago. We wrote about this in our 2021 research report (page 9). Here is the chart we shared in that report with the accompanying text.

In general, macro assets remained within an uncorrelated band (-0.2 to 0.2) in 2021. This is contrasted to 2H 2020, where gold and equities were somewhat positively correlated to BTC, and the U.S. dollar (USD) was somewhat negatively correlated to BTC. Bitcoin is a unique macro asset like no other.

Being uncorrelated is awesome, but wouldn’t it be fascinating if bitcoin was negatively correlated to stocks? And then, when that happened, stocks all went on a hell-train path to zero and bitcoin went up and up forever? That’s the Decoupling.

The Decoupling would force traditional financiers to start thinking about bitcoin as a risk-off asset. Yes – less risky than stocks. The volatile digital cash that mainly acts as a vehicle for speculation now will become less risky than stocks following the Decoupling

So, when Decoupling?

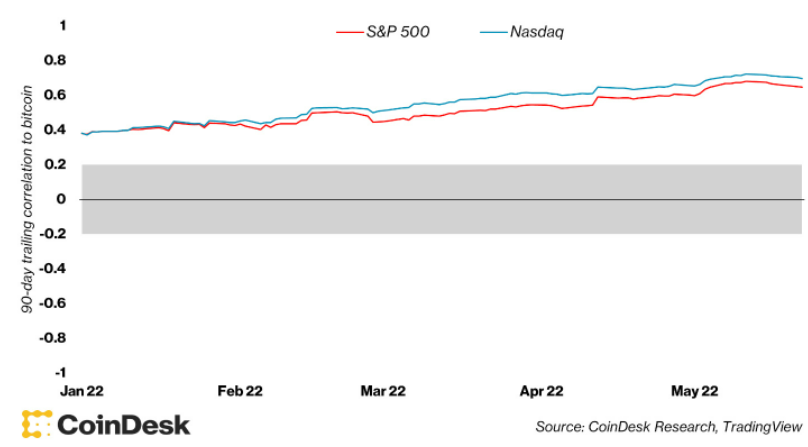

The Decoupling is also supposed to be aggressive; “Gradually, then suddenly” is one of its calling cards. Unfortunately, 2022 has smashed the dreams of an aggressive decoupling. Here are the 90-day trailing correlations in 2022 between bitcoin and the S&P 500 and the Nasdaq Composite Index:

This clearly isn’t the Decoupling, but it does look interesting. In 2022, these stock indexes moved from a weak positive correlation to bitcoin into the positive strongly correlated band (>0.7). While not as potentially impressive as a strong negative correlation would imply, bitcoin’s return profile still resembles a macro asset we haven’t quite seen before. Just a year ago the S&P 500 and bitcoin’s correlation coefficient was negative and close to zero. Correlation moving from near-zero to strong in a year is remarkable. On top of that, this correlation was strongly negative back in 2019.

So yes, bitcoin is unique. And thus, it bears repeating: Bitcoin is unlike any other macro asset we have seen.

This all reads like a whole lot of nothing, aside from bitcoin’s uniqueness (which we already knew). But there was something quite remarkable (and statistically insignificant) I saw last Wednesday when flipping through some charts. I saw this:

There it is, all the way to the left on this chart. The first signs of the Decoupling. When Decoupling? Maybe soon (but probably not).

轉貼自: Coindesk

留下你的回應

以訪客張貼回應